Recently, the Tax Administration Service (SAT) shared with us its CFDI update plan for 2022 that includes changes in the issuance of CFDI (which will convert to version 4.0):

Which are summarized below:

✓ Zip code of the tax domicile of the CFDI receiver. (Mandatory data)

✓ Name or business name of the CFDI receiver. (Mandatory data)

✓ Receiver tax regime (Mandatory data)

✓ New attributes are included for export purposes

✓ At concept level, an attribute is added to indicate whether or not it is subject to tax.

✓ There are adjustments in validation rules.

✓ A new element is added that impacts global/ recapitulative invoices (Direct impact on ticket portals and POS billing solutions).

✓ Related receipts, the structure is modified to give the possibility of indicating more than one type of relation to a CFDI.

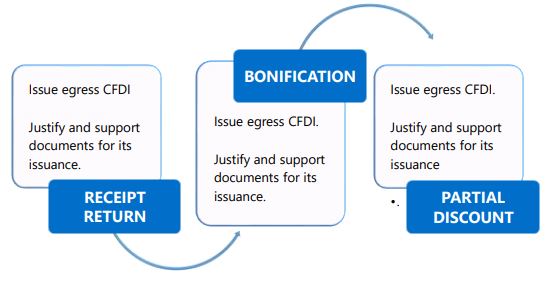

The credit notes type document egress in accordance with the reform proposal 2022 will not be considered deductible the credit note for invoice cancellation, when it is necessary to cancel an invoice, the procedure of rule 2.7.1.38 and 2.7.1.39 FMR (cancellation procedure) must be followed.

It can only be issued when they are made in the following cases;

*It is recommended to implement controls to be able to keep a correct record of each support for each credit note (egress CFDI) issued.

Update of the activities and obligations manifested in the CFDI, in case of discrepancy

When there is a discrepancy between the description of the goods, merchandise, service or the use or enjoyment indicated in the digital tax receipt and the economic activity registered by the taxpayer in terms of the provisions of article 27, section B, section II of this Code, the tax authority will update the economic activities and obligations of said taxpayer to the tax regime that corresponds to the taxpayers who were dissatisfied with said update, they may carry out the clarification procedure determined by the Tax Administration Service by means of general rules.

*It is recommended to choose the key of the SAT catalog of products and services based on the

declared economic activity.

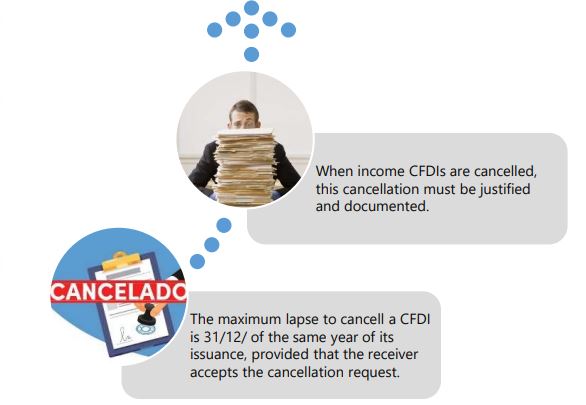

Changes to the Cancellation Service

CFDIs may only be cancelled in the year in which they are issued and provided that the person in favor of whom they are issued accepts their cancellation.

The Tax Administration Service, through general rules, will establish that when digital tax receipts are canceled via Internet that protect income, they must justify and support the reason for said cancellation, which may be verified by the tax authorities.

The next planned changes are as follows;

✓ They add the reason for cancellation (4 possible values) and for 01, the fiscal folio that replaces the canceled voucher must be indicated, which is the case of those that are related.

✓ Adjust the response codes of the service.

✓ Invoices cancellation without customer authorization will only be canceled to invoices with less than 24 hours of issuance and of less than $1,000 pesos.

✓ Validations to limit the cancellation of receipts to the year in which they were issued.

✓ Cancellation in global invoices issued by taxpayers of the simplified trust regime (RESICO).

*Infractions and fines related to the cancellation of CFDI, it is proposed to add a fraction XLVI to article 81 of the Code, to establish as an infraction, the cancellation of tax receipts outside the established period. By virtue of the above, it is proposed to add a fraction XLII to article 82 of the Code, to establish the applicable fine for the cancellation of digital tax receipts via Internet outside the established period.

✓ The field is added to express the total of the payments that are detached from the Payment nodes.

✓ The attribute is added to indicate whether or not the payment is taxed.

✓ DR exchange rate is renamed to DR Equivalence.

✓ DR payment method the field is deleted.

✓ The following fields are required:

• Partiality number

• Previous balance amount

• Absolute balance amount

✓ A new element is added for taxes, which includes the detail of the Transferred and Withheld.

✓ There are adjustments in validation rules and catalogues.